In the P&C insurance sector, where trust and reliability are essential, AI bridges the gap between operational efficiency and personalized customer care, even in a field where technology might feel impersonal. It fosters relationships that transcend transactional interactions.

According to McKinsey, insurance companies adopting AI-driven customer service see efficiency gains of up to 30%, with similar improvements in customer satisfaction scores. This can mean faster claims processing, improved underwriting accuracy, and enhanced customer retention rates.

How To Lock In Exceptional Customer Engagement and Efficiency in P&C Insurance With AI

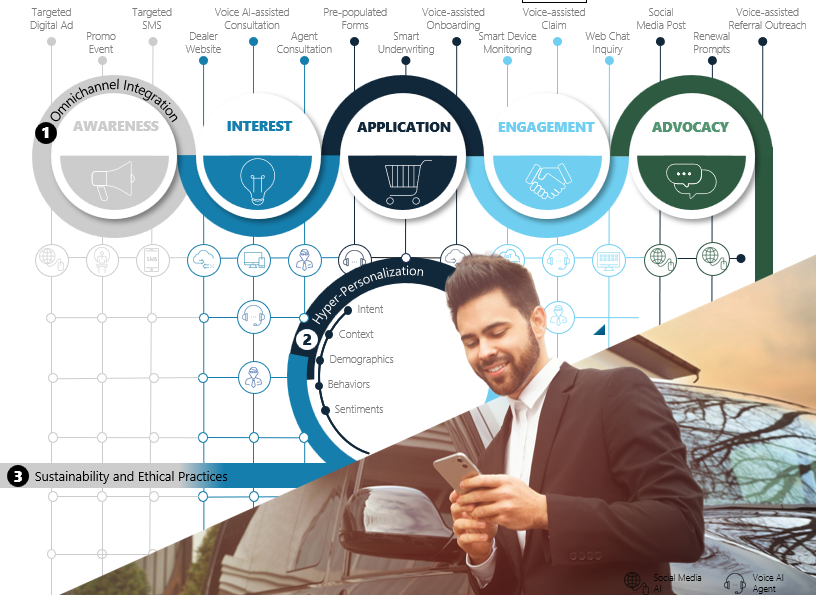

By focusing on omnichannel integration, hyper-personalization, and sustainability and ethical practices, we empower insurers, agents and brokers to create experiences that go beyond transactions. With AI, you can amplify what matters most—genuine, lasting relationships with your clients, your team, and the communities you serve.

1 |

OMNICHANNEL INTEGRATION |

| Omnichannel integration ensures customers can interact with insurers through their preferred communication channels, whether it’s SMS, web chat, voice AI, or in-person interactions. This approach minimizes friction in the customer journey, making services more accessible, reliable, and convenient.

AWARENESS Targeted SMS and Digital Ads: These tools engage customers proactively, providing them with relevant offers and updates. Promo Events: Organized campaigns create awareness and build stronger brand recognition. INTEREST Dealer Websites: Serve as digital storefronts that allow customers to explore policy options and learn more about services. Voice AI-assisted Consultations: Enable personalized, real-time assistance, building trust and interest. APPLICATION Pre-Populated Forms: AI reduces manual work by generating forms based on customer profiles, accelerating the application process. Smart Underwriting: Real-time risk analysis allows insurers to offer instant, tailored quotes. Voice-Assisted Onboarding: Personalized onboarding ensures new insurance customers feel valued and informed. ENGAGEMENT Smart Device Monitoring: IoT-enabled devices provide real-time data, such as accident severity, ensuring faster claims processing. Voice-Assisted Claims: Customers can file insurance claims seamlessly using voice AI. Web Chat Inquiry: AI-powered chatbots provide instant responses to customer questions. ADVOCACY Social Media Posts: These foster brand advocacy by sharing customer success stories and experiences. Renewal Prompts: Data-driven insights enable timely and relevant renewal communications. Voice-Assisted Referral Outreach: AI encourages satisfied customers to refer friends and family, boosting business. Modern consumers expect businesses to be available 24/7, and omnichannel integration aligns with these preferences. |

|

2 |

HYPER-PERSONALIZATION |

| Gone are the days when customers were treated as mere policy numbers. Hyper-personalization leverages data on intent, context, demographics, behavior, and sentiment to deliver highly individualized experiences.

How Hyper-Personalization Works:

For example, a customer filing a claim for a fender-bender could receive a personalized message with step-by-step guidance, minimizing stress and enhancing satisfaction. According to Salesforce, 76% of customers expect companies to understand their needs and preferences, making hyper-personalization a critical driver of loyalty. |

|

3 |

SUSTAINABILITY AND ETHICAL PRACTICES |

As industries embrace technology, sustainability and ethical practices must remain central to innovation. Customers today demand transparency and responsibility, especially when it comes to AI. These involve the following:

A report by Accenture reveals that 62% of consumers prefer companies prioritizing ethical AI. By embracing these principles, insurers can differentiate themselves and contribute positively to society. Here are some ways of incorporating ethical AI in your operations: a) Predictive analytics to identify high-risk areas and prevent losses; and b) AI-powered workflows to optimize claims processes and reduce waste. |

This streamlined process not only improves efficiency but also enhances customer satisfaction and loyalty, setting the insurer apart from competitors.

Transform Your P&C Insurance Operations with AI

Explore the many possibilities of AI for your business with The AES Group. It’s high time to deepen human connections, making them more meaningful and accessible with the power of AI.

Ready to take the next step? The AES Group offers a one-hour ideation workshop where we bring together technology, compliance, and other industry experts to collaborate with your team in reimagining your customer journey with ready demos and use cases that seamlessly, reliably and ethically integrate various channels to create meaningful connections with your customers.

Wherever you are in your business process, we’re here to help you. Contact us at [email protected].